Verification, known as KYC or ‘Know your customer’, is a process that is required by regulators to offer financial services to organisations and individuals. It involves reviewing and maintaining information on parties that use our financial services.

Below, we have provided details on the documents that are required for organisations to open an account with Mrkter in Australia.

- Required Documents

- Information about document types

- Supporting information

- New Business Supporting Documents

Required Documents

The documents you will need to provide will depend on your business type. Australian business types include Companies, Trusts or Sole traders and below we have provided details on the documents that are required for each.

1) Companies

For an Australian Company account, you may need to prepare the document(s) below:

- The Personal ID of each Ultimate Beneficial Owner (UBO) (if applicable)

- Authorisation Letter (if applicable)

- Partnership Agreement (if applicable)

- New Business Supporting Documents (if applicable)

2) Trusts

If you're signing up as a trust, you'll need to provide:

- a copy of the signed and executed trust deed

- a copy of the appointor/guardian or principal ID, as well as a copy of the trustees ID

2) Sole traders

For an Australian Sole trader account, you need to prepare the document(s) below:

- Your Personal ID

Information about document types

Below we have provided more specific details about the types of documents that you may need to submit as part of the KYC process covering:

- Personal Information

- Authorisation Letter

- Partnership Agreement

- New Business Supporting Documents

Personal information

Ultimate Beneficial Owner (UBO)

Ultimate Beneficial owner refers to an individual who owns or controls, directly or indirectly, including through a trust or bearer shareholding, more than 25% of the issued share capital of the corporation.

Personal ID

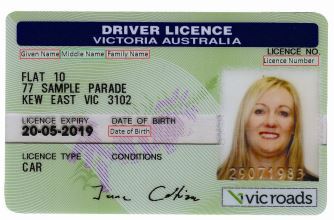

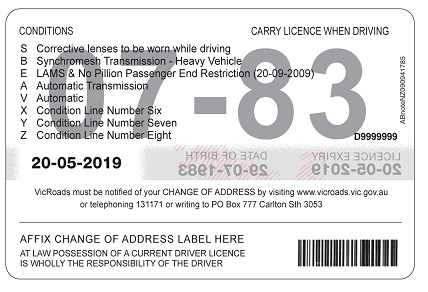

Please provide a photo image of a valid government-issued ID such as Drivers Licence or Passport.

Some valid ID examples are provided below:

1) Passport - All Countries

2) Driver's Licence - e.g. Australian sample

Please note, in some cases, we may also request you provide supplementary ID, such as your Australian Medicare card.

Also, if the UBO, Sole trader or Partner is a Chinese citizen, only Chinese National ID (身份证) is acceptable, and both the front and back side is needed. You can view a sample ID here.

Supporting information

Authorisation Letter

Please provide a letter (on a company letterhead) signed by two directors stating that you have the authority to open and act on the account on behalf of the company. If there is only one Director in your company then it is acceptable to only have one signature.

Click here to download the the Authorisation Letter example.

Partnership Agreement

Please provide us with a copy of your partnership agreement. If you do not have a partnership agreement then you download and use the sample below:

Click here to download the the Partnership Agreement Letter example.

New Business Supporting Documents

If your business is just starting out, we understand it can be hard to provide supporting documentation. However, please take a look at the exhaustive list below and see if there are some documents you can supply.

In addition, if there are any documents you can think of that might help us to verify your business that are not on the below list, feel free to supply them also.

- Contracts for sale;

- Bank statement showing business operations;

- Copies of sales or purchase invoices;

- Proforma invoices from suppliers;

- Proof of business insurance;

- Email communication between you and your suppliers/contractors/freelancers;

- Amazon / PayPal statements / screenshots;

- Receipts for software subscriptions, such as AWS or Xero;

- Proof of owning a website domain;

- Proof of being registered with an online marketplace (PayPal, Amazon);

- Business documents and policies to be used (such as Refund or Privacy Policy);

- A business plan;

- Utility bills issued in the name of the business (not for sole traders); or;

- Qualifications, membership of professional organisations, or membership on professional service registers or industry associations.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article